The County Treasurer plays a major role in local government by providing tax and revenue collection, banking services, cash and debt management, investment, financial reporting, and more.

An Elected Leader

Every county in Washington State has an elected Treasurer, except for King County whose Treasurer is an appointed position. The Washington State Constitution provides for a County Treasurer to be elected by the qualified voters of each county. In Clark County an elected Treasurer serves a term of four years and any person who is a qualified voter in the county may serve as County Treasurer.

COLLECT

$979.5 million in

property related taxes

INVEST

a portfolio with a

book value of $1.1 billion

BANK

and process nearly

$8.5 billion in transactions

MANAGE DEBT

totaling $1.4 billion on behalf of districts

What We Do

Property Tax Collection

Property tax billing and collection is a function of the tax service division of the Treasurer's Office. Washington State law directs this work (RCW 84.56). In addition, we process and collect real estate excise tax (RCW 82.45 and 82.46), gambling tax, as well as additional assessments.

Investment Pool

The Clark County Investment Pool invests cash reserves for all county departments and approximately 40 public entities, such as school, fire, cemetery, water and sewer, and other special purpose districts. The pool’s primary investment objectives are safety, liquidity, and return. The pool is only allowed to invest in certain types of highly rated securities.

Cash Management

The Treasurer assures the safekeeping of public funds as required by law by selecting a primary depository bank, maintaining records of all the deposits and withdrawals, and reconciles all bank statements.

Debt Management

The Clark County Treasurer's Office finance team manages debt on behalf of the county and its junior taxing districts which include school, fire, and library districts, as well as other special purpose districts. All debt is approved by the district’s governing board and/or by voter approval.

Treasurer's Office 2023-2027 Strategic Plan

Treasurer Topper and team are proud to share our strategic roadmap for the next five years.

As you read this plan, we hope you’ll see that the foundation of our work is cemented in our commitment to our values of continuous improvement; inclusion and teamwork; reliability, accuracy and accountability; and superior service. These values define what we stand for and guide our decisions and actions as public servants and treasury professionals.

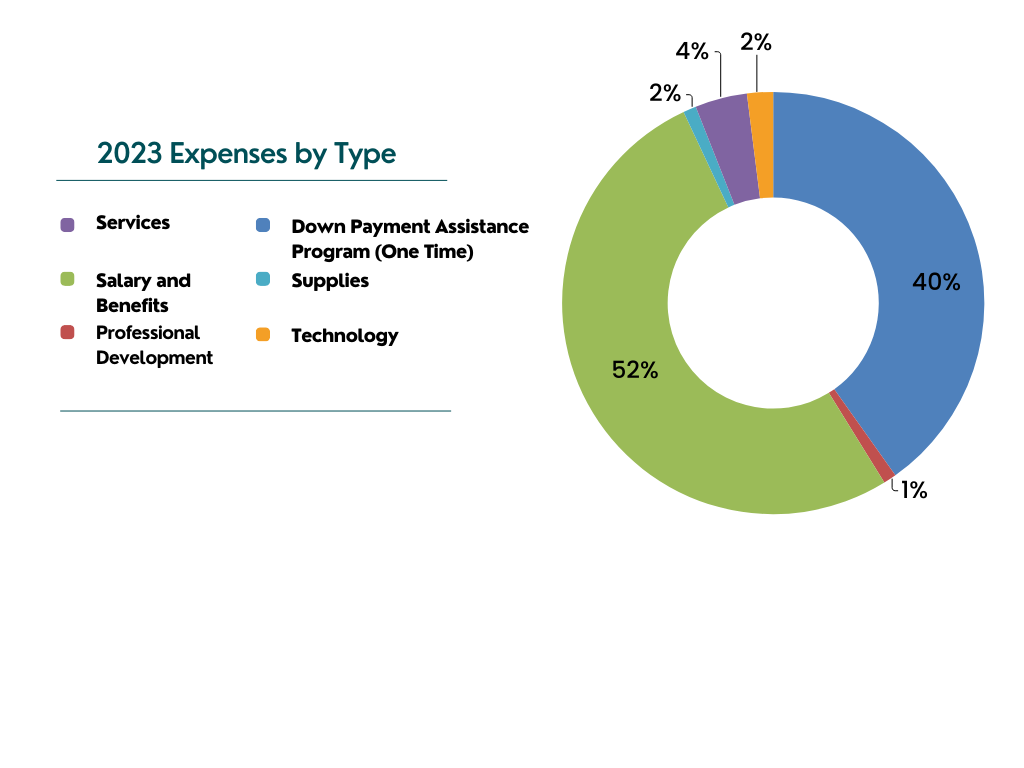

Office Budget

The Treasurer’s Office team calculates the cost to provide services and submits that amount in a budget request to the Clark County Council annually. The Clark County Council is responsible for approving all budget appropriations for the county departments and elected offices. Although the council sets the budget amount for the Treasurer's Office, by law they cannot dictate how funds are spent, that is the responsibility of the elected Treasurer.

Treasurer's Office 2022 vs. 2023 Budget to Actual

Totals are for General Fund & Treasurer's O&M Fund |

Staffing by Division

Administration

3 FTE

Finance

6.25 FTE

Tax Services

15 FTE